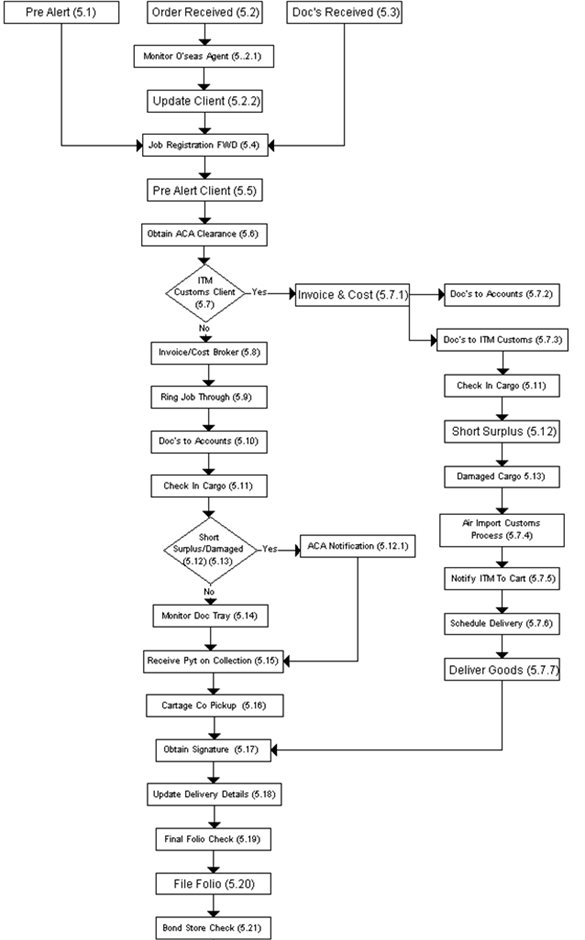

Air Import Forwarding Process

1. Introduction:

This document sets out the procedures for Importation of goods via Air within the ITM’s freight forwarding department.

2. Purpose:

The purpose of this procedure is to standardise and document procedural and legislative requirements as well as responsibilities in the Importation of goods via air within the ITM’s freight forwarding department.

3. References:

Department of Immigration and Border Protection

Customs Act

Department of Agriculture and Water Resources– Class 1.3 Quarantine approved Premises

ACN: 2006/17

ACCA: 2011/09

ACBP Notice: 2013/20

Air Import Customs Process (OP14)

General Warehouse/ 77G Depot / Transport Process OP17

4. Definitions:

4.1. Pre Alert:

Occurs when documents are received before the shipment arrives at the port of destination. These documents are used to start and often pre clear the shipment prior to arrival.

4.2. ACA:

Air Cargo Automation is an automated method of reporting arrival of inbound cargo to the Australian Customs and Border Protection Service.

4.3. Customs:

Department of Immigration and Border Protection

4.4. CTO:

Cargo Terminal Operator. Cargo Handling agent for airline

4.5. Cargo Release:

Document that is printed from ITM’s internal operating System

4.6. Underbond:

The movement of Cargo that is still under Customs Control from one licensed depot to another

5. Procedure

5.1. Order Received

Notified of an order placed on supplier by client.

5.2. Monitor Overseas Agent

Follow up overseas agent and monitor shipment until departure from overseas port.

5.3. Update Client

Import Air Clerk is to keep client informed of the progress of shipment paying particular care to expected departure date. If shipment is not on schedule customer must be informed by the Import Clerk. The Import clerk shall utilise the Order Tracking module.

5.4. Pre Alert

Overseas agents send prealert often in the form of a Master Air Way Bill and/or a House Air Way Bills and other documentation relevant to the shipment, e.g. Commercial Invoice, Fumigation Certificate.

5.5. Job Registration

The Import Air Clerk shall input details as prompted by the computer system, which entails transposing information from the paperwork into the pre-formatted screen. At the end of the process a Job number will be issued, which is known as a Folio Number Documents are kept in a Manila File with the Folio Number present and the Master Air Way Bill Number.

5.6. Pre Alert to Client

The Import clerk shall send via the Freightpac system a prealert to selected clients informing them of the arrival of cargo.

5.7. ITM Customs Client

The Import Clerk shall ascertain whether the client is an ITM clearance client, if so then a customs clearance job is created and the documents are sent to the customs clearance department, this includes whatever commercial documents have accompanied the HAWB, eg commercial invoices, packing list etc.

5.8. Cargo Automation

Once the registration process is complete the Import Clerk shall via the automated computer system send the Air Cargo Automation message to Customs for electronic status. The import clerk shall do a send receive until such time as an electronic clearance status is obtained. Refer ACN2006/17

5.9. Underbond Approval

An underbond approval MUST be obtained via Freight Pac

5.10. Original Documents Received

Original Documents are rung through to Import Air Clerk from Co-Loader. Import Air Clerk to draw cheque for freight amounts under AUD $5,000 and seek authorised signatories.

Amounts in excess have to be approved by Branch Accountant in order to check Foreign exchange rate, cheque to be given to Runner to collect Documents.

Documents may also be placed into our Airport box, which are collected by the Warehouse / Storepersons / Runner.

5.11. Manifest Presented

Once original documents are received a manifest is given to the warehouse staff for cargo check in, document labels are placed on HAWB’s. The warehouse staff receive 1 HAWB with a label when it is an ITM clearance.

5.12. Check In Cargo

The Storeperson shall check cargo into the Depot, which entails matching the number of pieces on the MAWB and or the HAWB to the physical cargo. The store person may then label the shipment with the identifying details. The manifest is to be completed with the date and time that the cargo arrives into the depot, along with the date and time the cargo is checked in/outturned.

5.13. Short Surplus

The Storeperson is to notify the Import Clerk if there are any short or surplus pieces and mark it in the relevant space provided on the manifest.

5.14. Damaged Cargo

Any cargo that appears to be damaged shall have a Damage Inspection Report (OP10.2) completed and an intent to claim lodged on behalf of the client. The form is then to send to the Administration manager for action.

5.15. Out turn

The Import Clerk shall notify Customs via the automated ACA system of the cargo check in details. Short, surplus and or damaged cargo is to also be followed up with the overseas agent. This is to be completed within 24 of the cargo arrival into the depot.

5.16. Invoice and Cost

*the shipment can be invoiced anytime once the relevant information is obtained

a) For ITM clearance

Invoice and cost the internal clearance account (99999M), when shipment was sent to the Customs Clearance department, ensuring all items are charged and costed as per quotation to client and as received by the overseas agent.

b) For NON ITM clearance

Invoice and cost the relevant Broker ensuring all items are charges as per quotation to client and as received by the overseas agent.

The job is rung through by the Import Clerk or the Assistant to the relevant Broker informing them of costs. The Import clerk shall write the date, time and person spoken with on the paperwork for verification. The job is then placed in a document tray awaiting collection.

Import Clerk is to:

- Check Buy Rate

- Check Sell Rate

- Approve Overseas Invoice

5.17. Receive Payment on Collection

The Import Clerk shall ensure a signed cheque is collected on collection of documents by other brokers. At this point the amount of the invoice must be checked against the value of the cheque.

5.18. Cargo Release /Cartage Company Pick Up

Upon Presentation of the original HAWB

a) For ITM clearance

The store person shall check the status of the shipment from the import job screen and when customs cleared shall print a cargo release and attach it to the original HAWB

b) For NON ITM clearance

The import clerk shall check the status of the shipment from the import job screen and when customs cleared shall print a cargo release and attach it to the original HAWB.

The storage date shall be checked and if storage is applicable then the charge shall be calculated at the ITM storage rates and receipt issued.

5.19. Obtain Signature

The Storeperson shall ensure that any cargo picked up from ITM’s store has been Duly signed for on the cargo release, with the date and time of pickup and Name of driver and vehicle registration. The signed cargo release and HAWB are to be scanned onto the system.

5.20. Final Folio Check

The Import Manager shall perform a final Folio Check to ensure all work was carried out correctly and in a timely fashion, whilst also verifying that all documents are in place for that particular consignment and all cargo is delivered.

5.21. Bond Store Check

On a Cycle not exceeding fifteen days the Storeperson shall perform a Bond Store Check and fill out the Bond Store Check form (OP10.3) completely and hand to the Import Manager.

5.22. Bond Store Check Review

The Import Manager shall review and investigate all occurrences of cargo determining which cargo has been within ITM warehouse for in excess of 24 days.

Cargo in excess of 30 Days is to be reported to Customs and if required be taken to a queen’s warehouse and an ACA message sent to Customs via Freight Pac.

5.23. Monitor Doc Tray

The Import Clerk shall monitor the document tray to ensure that all documents are collected in a timely fashion and ensure that date and times are written. If not collected then procedure (5.13) is to be performed again.

6. Documentation

OP10.2 Damage Inspection Report