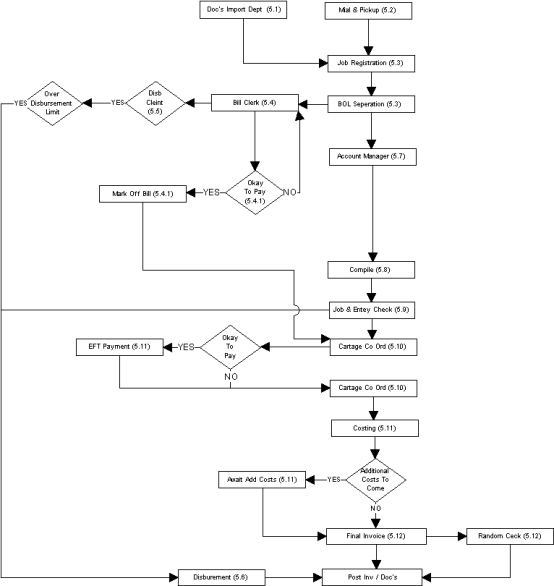

Customs Sea Process

1. Introduction:

This document sets out the procedures for the Clearance formalities associated with the importation of goods as required by the Australian Customs Service and the Australian Quarantine Inspection Service.

2. Purpose:

The purpose of this procedure is to standardise the clearance process.

3. References:

Australian Customs Act

Australian Quarantine Act

4. Definitions:

4.1. Disbursement: Relates to monies paid out on behalf of clients.

4.2. Entry: Relates to the Customs Entry, which represents the formal documentation, required by Customs for Importation.

4.3. ABF: Australian Border Force

4.4. DAWR: Department of Agriculture and Water Resources

5. Procedure

5.1. Docs from Import Department

The Import Clerk shall give to the runner documentation for shipments that are to be Customs cleared by ITM. These documents shall be given to the Customs registration Clerk.

5.2. Mail/Email

The customs Department will receive documents via the mail or email where depending on time frame of shipment the documents would be either posted or electronically received.

5.3. Job Registration

The registration Clerk shall transpose the relevant information into the freightpac computer systems were a job number would be issued. Then a copy of the Bill of Lading is then given to the Bills Clerk.

5.4. Bill Clerk

The bill clerk shall Investigate Vessel arrival times and arrange for payment of

Charges to shipping companies / Forwarders upon arrival of the vessel. The charges are forwarded as instructed by the Account Manger once received to the accounts clerk for disbursement invoices to be raised.

5.4.1. Once ready to pay the charges the Bills Clerk shall surrender the BOL to the shipping companies / forwarder and pay the charges owing on the shipment, at this point the Clerk shall receive a delivery order. The Delivery Order shall be given to the Cartage Co Ordinator.

5.5. Disbursement Client

The account manager may wish to raise a disbursement invoice, if so the account manager shall inform the accounts clerk to do so informing them of amounts to be included.

5.6. The Accounts Clerk shall raise a disbursement as instructed by the Account Manager. The invoice and or supporting documentation shall be placed in the mailing tray to be mailed out.

5.7. Account Manager

The Account Manager shall classify all imported items in accordance with the ACS Tariff. The Classified shipment will then be handed to the Compile Clerk for entry Into the Freightpac system. The Account manager shall insure that all formalities are executed in accordance with the Australian Customs Act and the Australian Quarantine Act ensuring all supporting documentation is present.

5.8. Compiler

The Compile Clerk shall transpose the Classification and all other fields as

predetermined by the Freightpac computer system. The compiler shall hand the folder with the accompanying entry back to an account manager.

5.9. Job & Entry Check

The Account Manager shall check the correctness of the produced entry. The Account Manager will electronically lodge the entry with customs if O.K. If the Account Manager wishes a disbursement invoice to be raised a copy of the entry must be handed to account for a disbursement invoice to be raised. The Folder shall then be handed to the Cartage Co Ordinator.

5.10. Cartage Co Ordinator

The Cartage Co Ordinator shall check the availability of the cargo and that all

necessary documents are in place for the collection and delivery of cargo.

If the cargo is available within a short time the documents are then handed back to the Account Manager. Once the documents are received back from the Account Manager with a Delivery Advice the Cartage Co Ordinator shall schedule delivery as instructed by the client utilising a supplier from the approved supplier list.

5.11. EFT Payment

The Account Manager shall pay the duty relating to the shipment when the cargo availability is imminent.

5.12. Costing

The Account Manager may cost all relevant items on the Job Costing Sheet. If additional costs are imminent the Manager shall hold from invoicing till these are received.

5.13. Final Invoice

The Accounts Clerk shall enter all the check requisition that relate to customs jobs into the Freightpac system against the relevant jobs. The daily duty receipt from the ACS shall also be processed into the Freightpac system against the relevant jobs.

The Job Costing Sheet shall be doubled checked against the costs that already appear in the computer and discrepancies reported to the Account Manager. The Accounts Clerk shall proceed to raise a final invoice in the Freightpac system.

6. Documentation: