Accounts Receivable Process

1. Introduction:

This document sets out the procedures for the maintenance of accounts receivable ledgers.

2. Purpose:

The purpose of this procedure is to standardise and maintain the company’s cash flow requirement as well as the effective minimisation of bad & doubtful debts.

3. References:

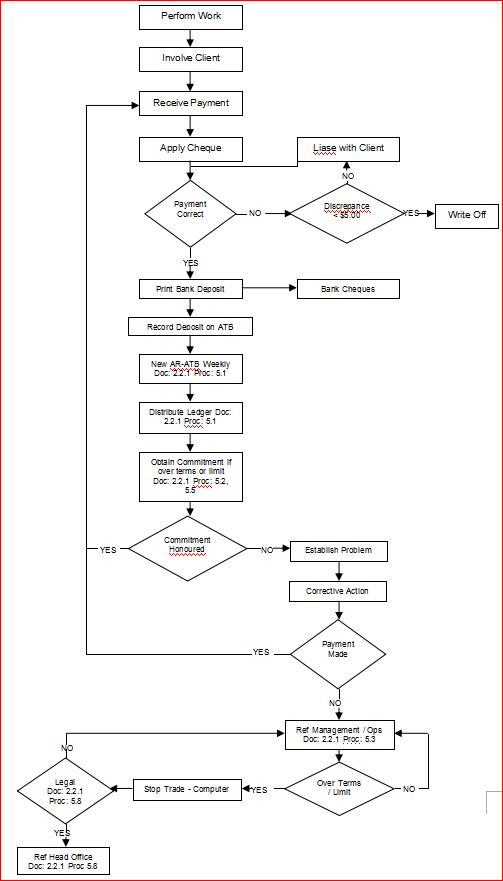

Flow Chart of Accounts Receivable Process

4. Definitions:

4.1. Accounts Receivable: Commonly known as Debtors, is a company and or an individual that is indebted financially to ITM for services performed.

4.2. Outstandings: Moneys that are due outside trading terms.

4.3. Trading Terms: The agreed amount of time a client has to pay monies due. Final invoices are due and payable once they are in the greater than 60 Day column of the Accounts Receivable ledger.

Disbursement invoices are due and payable at the expiration of 14 days from date of invoice.

4.4. Final Invoice: Are invoices that are printed with the words Final Invoice on the invoice document and usually covers all service charges.

4.5. Disbursement Invoice: Are invoices that are printed with the words Disbursement invoice on the invoice document and usually covers monies disbursed.

4.6. Stop Trade: A field in the computer that can stop trade with clients by not allowing any records to be modified or corrected for the client.

5. Procedure

5.1. Branch Accountants are to run and distribute all individual and branch AR ledgers every Monday Night for distribution on Tuesday morning.

5.2. Accounts & operations are to peruse all outstanding’s outside our agreed trading terms. Notations are to be made on the ledger for ease of reference outlining the commitment obtained and the date it was obtained.

5.3. Refer all problems and requests for credits to Sales or Operations after notation is made on the AR ledger.

5.4. All requests for credit should be completed on a request for credit form (FN11.1) and Authorised by the Department Manager and forwarded to the Branch Accountant.

5.5. Accounts & operations are to ensure that all amounts outside trading terms are contacted and notations made on the AR ledger.

5.6. The previous week's ledger is to be presented to the branch manager every Monday morning.

5.7. Branch manager is to review all outstanding’s and liaise with accounts and operations to ensure monies outside trading terms are recovered.

5.8. Branch Managers shall report any legal matters to the Financial controller for action.

5.9. A list is to be prepared by the Branch accountant/ administration manager and submitted to the Branch Manager within 5 working days of the end of the month. The list will include all clients with final invoices exceeding 60 days and all disbursements that exceed 14 days. The list will also include comments as to the state of affairs.

6. Documentation: